2

Share this post

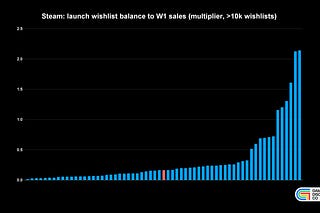

Plus: Infection Free Zone, Gigantic, Spirit City go places on Steam

newsletter.gamediscover.co

The GameDiscoverCo newsletter

Analysis, data and insight about how people find & buy video games in the 2020s.

Recommendations

View all 7mobilegamer.biz

Dmitriy Byshonkov

Matej Lancaric

Stephen Totilo

SuperJoost

Share this publication

The GameDiscoverCo newsletter

newsletter.gamediscover.co

© 2024 Game Discovery Now LLC

Substack is the home for great culture